All About Risk Management Enterprise

Table of ContentsRumored Buzz on Risk Management EnterpriseRumored Buzz on Risk Management EnterpriseGetting The Risk Management Enterprise To WorkThe Buzz on Risk Management EnterpriseThe Single Strategy To Use For Risk Management EnterpriseThe Best Guide To Risk Management EnterpriseSome Known Facts About Risk Management Enterprise.

By leveraging an aggressive expectation and carefully considering various circumstances, you have the ability to have a far better understanding on possible dangers that your service can deal with. When you have an understanding and clear outlook, you can choose how to continue to line up actions with business objectives. In doing so, you develop and cultivate a society that is not scared of threats, in addition to one that operates with both dexterity and durability.With a strong threat administration strategy, you're presenting your level of treatment and intent to stakeholders, which breeds self-confidence - Risk Management Enterprise. By comprehending risks, leaders and monitoring groups can appropriately assign sources to finest manage future results. This consists of funds, in addition to just how to designate duties to different individuals within your group in order to best carry out and manage the selected strategy of action

Risk Management Enterprise Fundamentals Explained

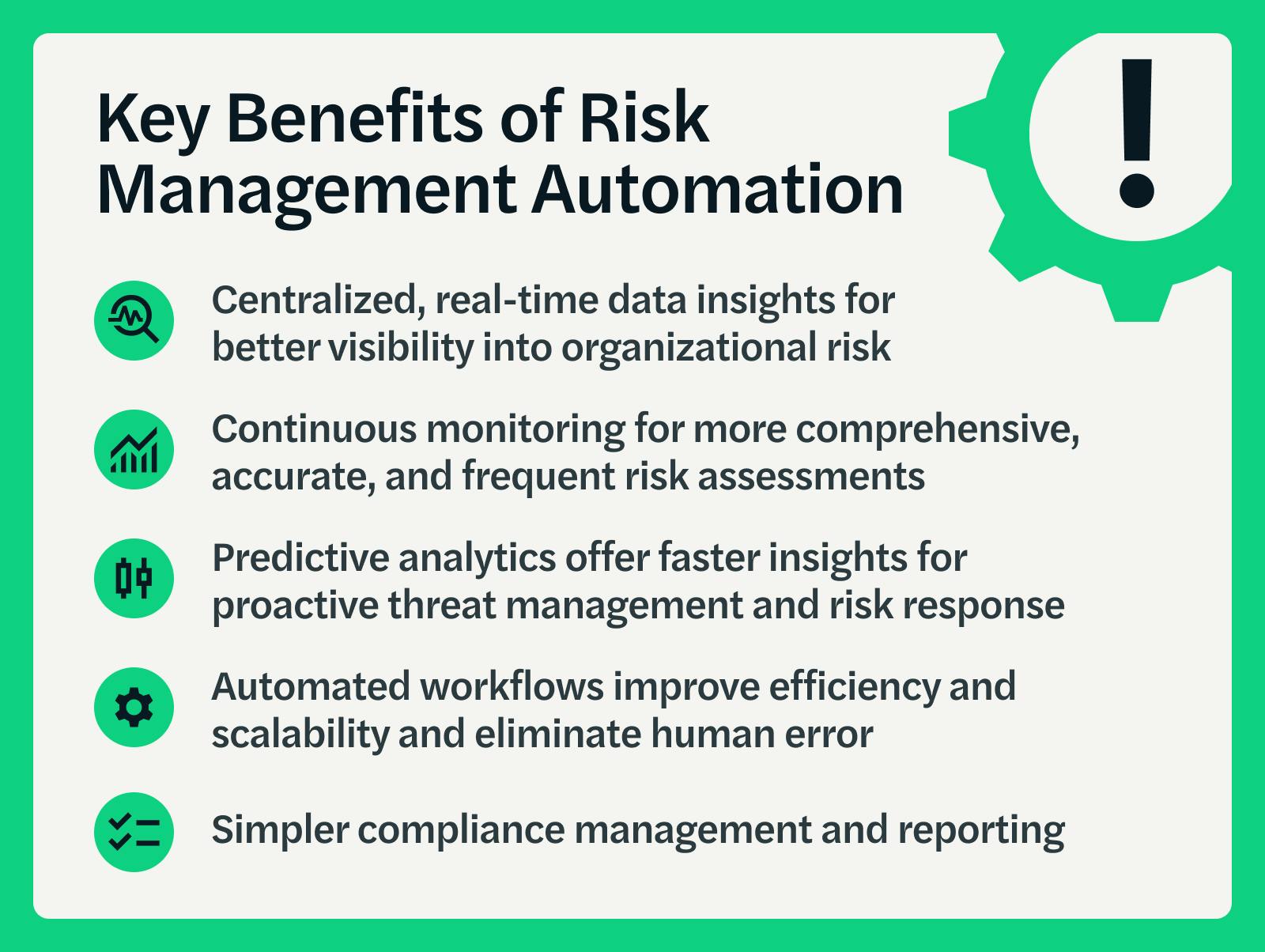

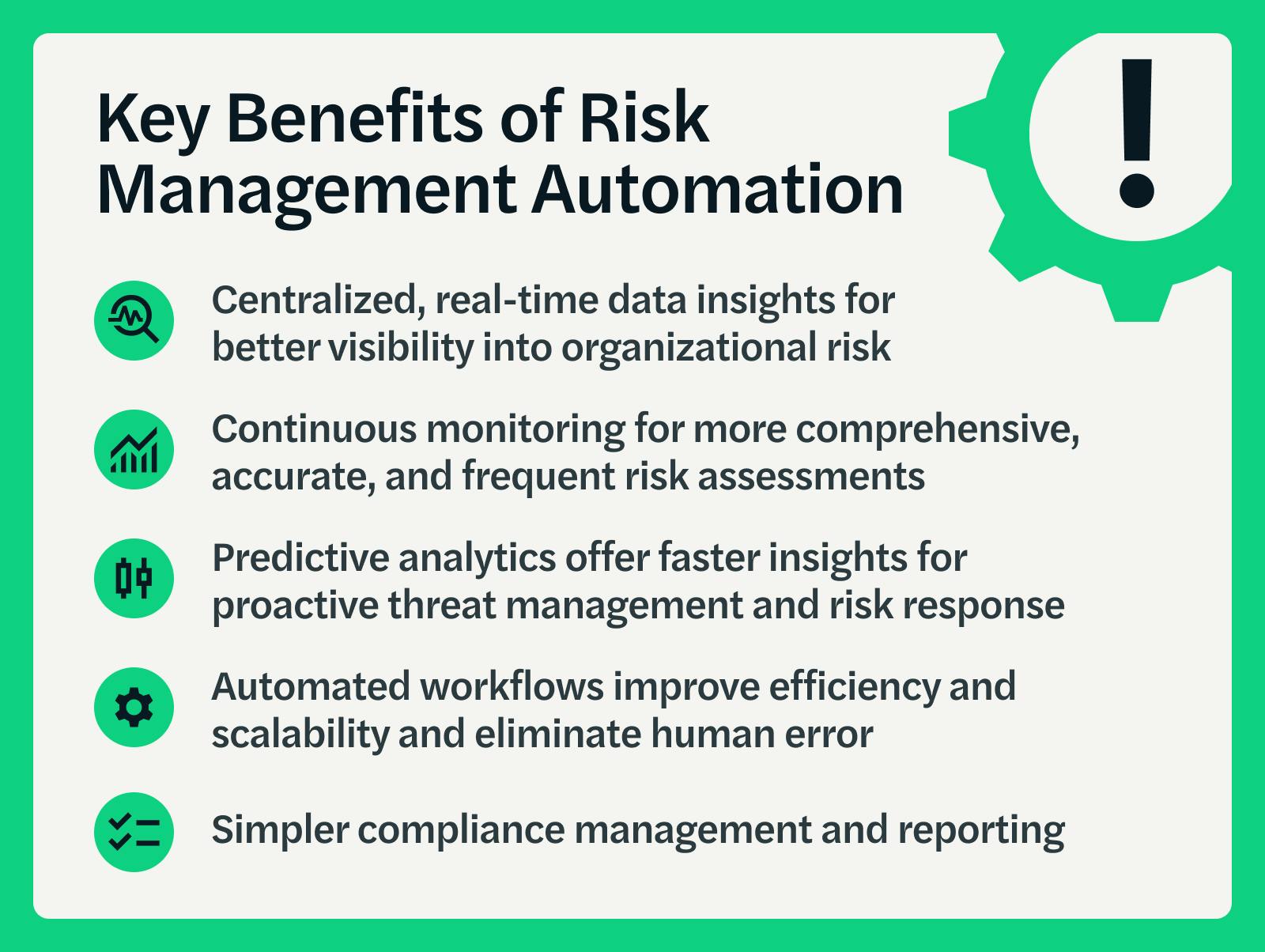

With automation software program, you can rest assured that you'll have all your business's information nicely systematized and ready-to-use for analysis or recommendation. While the details of every organization's risk administration strategy will certainly differ, there are best techniques worthwhile to think about and follow to effectively exercise threat monitoring. Remember these recommendations: Keep the organization's goals at the center of every choice Be organized Utilize information and data for decision-making Include everybody in your company that is involved Display regularly and make changes as needed Create value for the company Use technology and automation software wherever possible There might be various other occurrences and scenarios that approach that obstacle your danger administration prepares to crumble.

A small error can cause major damages, especially in very regulated markets such as finance. And, also if all individuals are in location and educated, mistakes occur that can be as a result of poor administration. Risk Management Enterprise. That's why it's important to have trusted software application, typical methods, and oversight in area to protect your company versus problems and errors

Throughout, hyperlinks attach to various other articles that deliver even more comprehensive information on the topics covered here. Danger administration is essential to business success-- arguably much more so currently than ever. The risks that modern organizations deal with have actually expanded extra intricate, fueled by the rapid pace of globalization. Brand-new threats constantly arise, often related to the now-pervasive use of technology.

Some Known Facts About Risk Management Enterprise.

Lots of organizations are still facing a few of the risks posed by the COVID-19 pandemic. That consists of the ongoing demand to manage remote or hybrid job atmospheres and what can be done to make supply chains less susceptible to disturbances. Therefore, a danger management program must be intertwined with organizational approach.

Below's a primer on threat exposure in a company and how it's determined. Many specialists note that handling threat is a formal feature at companies that are heavily managed and have a risk-based company design. Financial institutions and insurer, for instance, have actually long had large danger divisions commonly headed by a chief danger officer (CRO), a title still fairly uncommon outside of the monetary sector.

Excitement About Risk Management Enterprise

For other sectors, threat has a tendency to be more qualitative. That enhances the need for an intentional, comprehensive and consistent method to run the risk of monitoring, stated Gartner practice vice head of state Matt Shinkman, who leads the consulting company's danger administration and audit techniques.

Display the outcomes of threat controls and change as essential. These actions audio uncomplicated, but threat administration committees established up to lead initiatives should not undervalue the work needed to finish the procedure.

They also document risk feedback plans, threat owners click here and stakeholders, and the price of taking care of risks. A downloadable danger register design template can be discovered in the post connected to above. Companies can gain these advantages by making use of a risk register as part of their risk monitoring programs. As government and industry compliance rules have actually increased over the past twenty years, regulatory and board-level analysis of company threat administration practices have also increased.

Strategy and objective-setting. Info, interaction and reporting. ISO 31000.

Examine This Report on Risk Management Enterprise

The more recent variation additionally emphasizes the crucial duty of senior administration in threat programs and the assimilation of risk administration techniques throughout the organization. Some nationwide standards bodies and teams have likewise launched country-specific variations of ISO 31000. The American National Criteria Institute supplies a version that's overseen by the American Culture of Safety Professionals.

Threat averse is an additional quality of companies with typical risk management programs. For numerous business, "threat is an unclean four-letter word-- and that's regrettable," Valente said.

Conventional danger management additionally often tends to be reactive. In venture threat monitoring, handling danger is a collective, cross-functional and big-picture effort. An ERM team debriefs business device leaders and personnel about risks in their locations and helps them think with the risks. The group then looks at information regarding all the risks and offers it to elderly executives and the board.

Risk Management Enterprise - Truths

The former work at companies that see danger monitoring as an insurance coverage, according to Forrester. Transformational CROs concentrate on their business's brand name track record, recognize the straight nature of risk and sight ERM as a means to allow the "appropriate quantity of threat needed to expand," as Valente placed it.

A lot more self-confidence in business purposes and objectives because threat is factored right into method. Better and more effective compliance with regulatory and inner requireds. Improved operational performance with more regular application of threat processes and controls. Improved office security and safety. A competitive benefit over service competitors with less fully grown danger monitoring programs.

ISO 31000's overall seven-step process is a useful guide to adhere to for establishing a strategy and afterwards applying an ERM structure, according to Witte. Below's a much more detailed run-through of its components: Interaction and consultation. Raising threat understanding is an important part of risk administration. The communication plan created by risk leaders need to effectively convey the company's threat plans and procedures to employees and various other pertinent events.

Risk Management Enterprise for Beginners

Developing the range and context. This step requires specifying both the company's risk appetite and threat tolerance. The latter term describes just how much the risks related to details campaigns can vary from the general risk appetite. Factors to consider below include business purposes, business society, regulative requirements and the political setting, to name a few.